Fulton officials set real, tangible tax rate

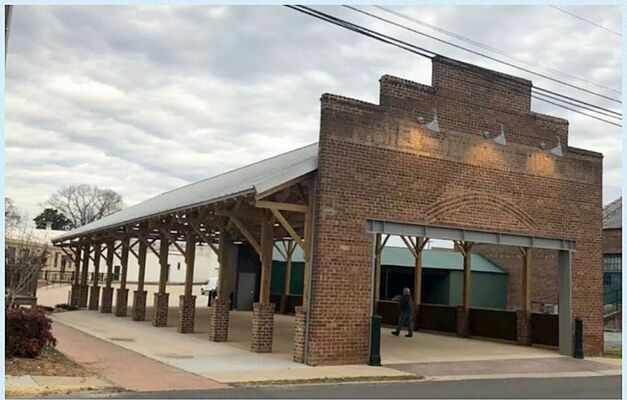

FUTURE FARMERS’ MARKET FUNDING PURSUED – Pictured above is a rendition of a permanent Farmers’ Market planned for construction in downtown Fulton. City Manager Mike Gunn and Ashley Wiseman compiled a business plan and grant application to pursue a matching grant for construction costs with Fulton City Commission offering support for the grant process. (Photo submitted)

FUTURE FARMERS’ MARKET FUNDING PURSUED – Pictured above is a rendition of a permanent Farmers’ Market planned for construction in downtown Fulton. City Manager Mike Gunn and Ashley Wiseman compiled a business plan and grant application to pursue a matching grant for construction costs with Fulton City Commission offering support for the grant process. (Photo submitted)

Although a decision was reached by Fulton’s City Commission as to the 2020 City Property Tax rate, it was reached reluctantly Sept. 14.

Mayor David Prater and Commissioner Elaine Forrester each expressed their apprehension to enact any appearance of a tax hike for the citizens of Fulton, however, each also confirmed and understanding of the city’s financial condition, which includes the loss approximately $1 million in tangible property tax revenue.

“I am not for raising taxes,” said Mayor Prater, but added as he saw there was no option to avoid it.

“We are kind of in a bind right now,” Commissioner Forrester said.

City Manager Mike Gunn included the tax issue on the night’s regular session agenda at Fulton City Hall’s Commission room, after the officials had been provided with information and options at the previous commission meeting.

Gunn explained that with substantial loss, especially as the result of a major decrease in payroll tax collected because of covid-19 related layoffs and staff reductions, if the city chose to take the sub, or compensating rate, $9,000 would be to the city’s good. The sub/compensating rate would only allow the city to collect equivalent to their preceding year’s revenue from taxes.

Should the commission choose to increase the tax rate up to 4%, it would garner $9,900, and would require public notices and added expenses.

“I would rather see us go up incrementally, rather than such a large increase, as we had to do for utilities,” Gunn said.

He reported with the compensating/sub rate, the real property rate would go from .2980% to .3090%, per $100 assessed valuation.

That increase, Gunn used as an example, would result in real property taxes paid on a home valued at $100,000, going from $298 to $309 for the year.

Mayor Prater, Commissioners Forrester Darcy Linn and Jeff Vaughn, present at city hall, and Commissioner Martha Vowell, present via Zoom videoconferencing, voted in favor of accepting the sub/compensating rate.

The first reading of the ordinance to establish the tax rate for the real property, and personal (tangible) property was heard, with a second reading and publication required for adoption. The personal (tangible) property rate will be at .3683%.

Gunn provided for the officials’ consideration, a Municipal Order, 2020-20, by which authorization would be provided for the city to not participate in the Payroll Tax Deferral Plan, from the Presidential Executive Order.

He said he had been approached by employees of the city, who had requested to opt out of the deferral, and after he had conducted his own research, he believed it to not be beneficial to employees, as the option was only a deferral and all taxes not withheld now, would be withheld, subsequently doubled, after January. Gunn also noted should an employee decide to take the deferral now, and then no longer be employed with the city in January, there would be no way for the city to recover the taxes owed. The Municipal Order was approved.

The second reading of Ordinance 2020-06 was read, Enacting and Adopting a Supplement to the City Code of Ordinances.

Ashley Wiseman, Administrative Assistant for the Ken-Tenn EMS, was introduced by Gunn, and recognized for her accomplishments in preparing grant documentation to the Kentucky Agricultural Development Fund for the Farmers Market Project downtown Fulton, and through a Municipal Order, the necesary paperwork was approved for submission by the Mayor and Commissioners.

The Mayor was authorized to execute and and all documentation necessary for the submission of the grant application.

Mayor Prater asked if Kentucky Farm Bureau, at the local and state levels, had been notified as to their inclusion in the process to construct the downtown Farmers Market, as the company had been a longtime contributor toward maintaining the previous Farmers Market, located on the Fulton County Transit Authority property.

Gunn said Kentucky Farm Bureau would continue to be a partner in the process of constructing the new Farmers Market as well as the grant process to apply for the matching grant, $176,000, with $88,150 of that total required to be funded locally.

Gunn said following the Commission’s approval, he and Wiseman would complete the packet and forward it prior to the deadline of Sept. 18.

Commissioner Forrester asked Code Enforcement Officer Nathan Lamb, present via Zoom, if he had determined whether someone was residing in a house on Eddings, which had previously been cited for failure to comply with city ordinances.

Gunn said it had been made clear by the buyers of the property that no one was to live in the house prior to the structure being brought into compliance. Lamb said he had made several attempts to contact and speak with the adults at the property but only minors had been at home at the time of his visits to the property and although he had left messages he had received no response from the owners.

Gunn updated the officials on an improvement noticed relating to residents adhering to trash pickup requirements and the use of garbage containers.

Commissioner Vowell questioned whether large items, such as railroad ties were to be placed curbside for pickup, and she was told those type items would not be picked up. She also said she had noticed a neighbor had raised his culvert, to the extent water was now being diverted onto her property.

Both Gunn and Mayor Prater responded the matter would be considered a civil issue and the city would not be involved with it at this point. It was suggested Commissioner Vowell speak to the neighbor or mail a letter stating her grievances regarding the matter.

During the portion of the meeting designated for remarks and requests from visitors, Thea Vowell, Fulton Tourism and Twin Cities Chamber of Commerce Executive Director, addressed the commission on the ongoing problem with an increasing cat population within the city.

She said several months ago, a cat had made its way onto her property, underneath her house. She ultimately sought medical care for the cat and decided to keep it as a pet, although she had had no intention of obtaining a cat as a pet.

Then, she reported last week, she had discovered a female cat, had found a way into her fenced back yard and shed area, and given birth to a litter of cats. Two of the kittens appeared to be sick, so she also took those cats to the Veterinarian and purchased medication for them, but she did not want to take on the kittens, which she brought with her to the meeting.

“What am I supposed to do?” Vowell asked. In addition to the problem of the cats coming on to her property she said her pet cat had been injured by a stray cat, and that ultimately caused the necessity of a trip to the Vet and more expense.

Commissioner Forrester suggested giving the kittens to Commissioner Linn, who has been a longtime volunteer at the city’s pound, taking care of stray and abandoned animals there.

Linn finds organizations which will provide rescue services for the animals.

Vowell said she would like to see the city begin to take action against pet owners who do not take care of the animals they have, and at the least, enforce the ordinances already in place within the city regarding animals, such as the prohibiting of more than four animals at any residence, kept outdoors.

Mayor Prater asked Fulton Police Chief Terry Powell how difficult it would be to police such an action, and about the details of the current ordinance addressing the violations.

Chief Powell said that fines can be incurred up to $500 for violations.

Commissioner Linn reported in the prior year, she had transported, or arranged for the transportation of more than 500 animals to rescue organizations and that was an extremely large number for a community the size of Fulton.

Vowell asked if there could be some starting point, as to addressing the ongoing problem with the excessive number of cats.

Commissioner Martha Vowell as well as the other Commissioners and Mayor Prater agreed that the formation of an ad hoc committee to research possible options to approach the ongoing problem with cats within the city could be a starting point and that South Fulton officials and residents there could also be a part of the committee, as the over abundance of cats unattended within the community impacts both towns.

According to Chief Powell, the current ordinance on the city’s books relating to animals held at the pound allows for euthanasia after the animal is not claimed for seven days, however Commissioner Linn said she was diligent to do all she could for other options, such as rescue organizations, instead of that process.

Gunn said currently the city covers the cost for utilities at the pound, and Fulton County contributes some funds toward the pound’s expenses. Commissioner Linn said there are generous contributions made on an ongoing basis for the provision of food and vetting expenses as well.

Please support The Current by subscribing today!

You may also like:

Loading...

Loading...